- LEVEL UP NEWSLETTER

- Posts

- LUN #001 10 Systems To Profitable Trading Automation

LUN #001 10 Systems To Profitable Trading Automation

The system that made 435% in 98 days

THE 5% TRADER

GM.

Buff here.

We always see some kind of disclaimer on exchange or broker about 90-95% of traders fail long term and it looks like the odds are stacked against us from the beginning.

Newsflash, that is the same odds as any other fields:

Only 5% business are actually successful.

Only 5% investors are actually profitable long term.

Only 5% corporate’s workforce are top level management.

Only 5% athletes ever reach highest level competition floor.

Only 5% internet entrepreneurs ever actually make real money.

You get the point.

In the world of hard I choose to trade because I love it, specifically trading automation and to be able to choose my hard is a form of freedom and privilege many don’t have.

But do you have to be the top 5% before you become a profitable trader? No.

So how to be a profitable trader?

The answer is having a system.

3 years ago when I started, I don’t understand the importance of having system because I don’t know what I don’t know.

I took a lot of pain from the market during my learning process that forced me to pause than just keep trading sporadicly.

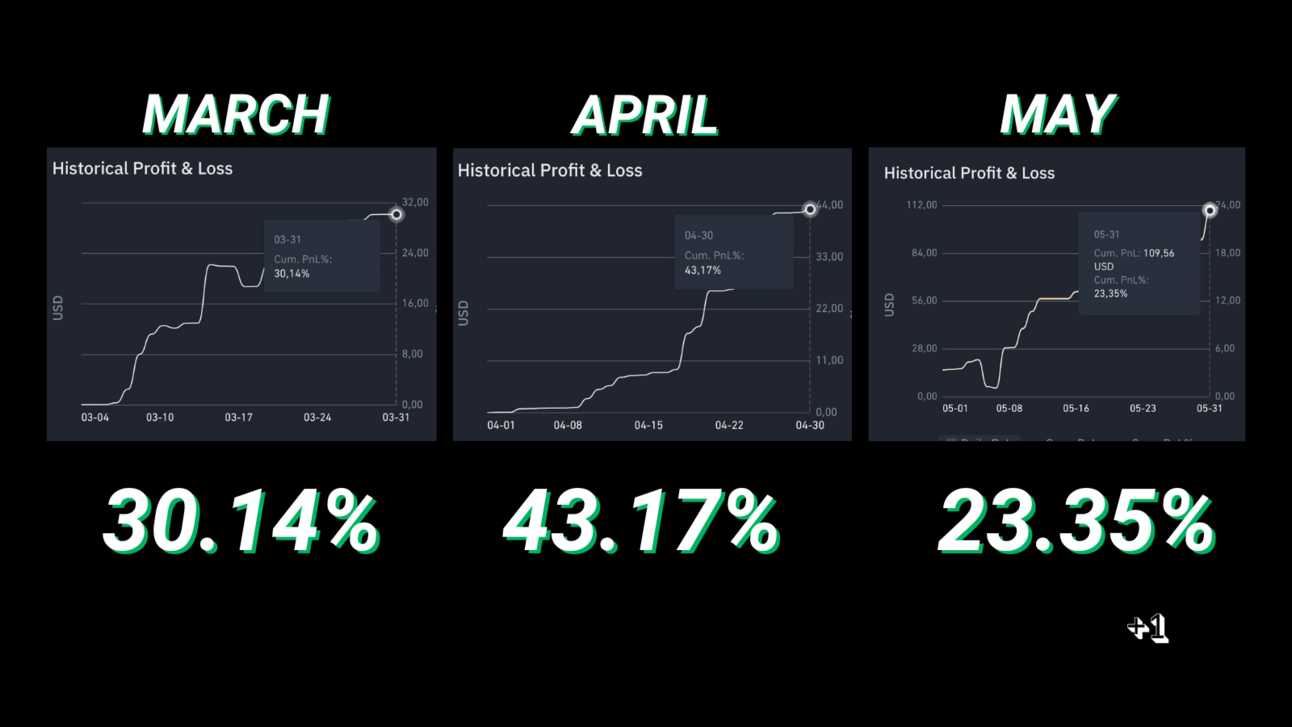

I made myself a system and once I did, I started seeing result:

At the time of this writing, mid June alone have made 89.89% which made a compound return of 435% since March.

This is automated with no more than 1 hour screen time daily, sometime less.

So here are the system that made me profitable and the reasoning behind it:

Be specialized

Choose one pair to trade, understand how it move historically and be really good trading at it. Two pairs maximum.

The reason is every pair may look like it move the same but if you look deeper, each have different volatility, volume, liquidity, tick size, news, etc.

You won’t be able to watch every news nor you can automate your strategy to react to news, so it doesn’t make sense to trade all pairs and hope to profit from it. Hope is not a strategy.

Choose your pair to trade base on this:

Top 50 pairs by market cap.

Use volatility index and trade the one that fit your risk profile. I am on low.

Focus on automation.

My goal is to keep doubling my profit with least effort possible and that is why I am very into automation, to make my life simpler and easier.

I keep my system clean and simple by accepting this:

Not trading all pairs.

Missing some opportunity that I don’t understand.

Having complex system means I need to watch it more and that defeat the purpose of automation.

Being complex doesn’t always equal profit but it does equal confuse the hell out of yourself when market are moving.

Trade like how best investors invest

To me investing and trading simply comes down to how long you hold your position.

So I learn from the best investors like Mohnish Pabrai, Warren Buffett and shorten my holding period significantly.

They only buy when things are cheap meaning they are buying when everyone is selling and vice versa or simply, they are countering what the trend are doing so I trade accordingly, I counter trade the market.

Here is how it looks on the chart:

You see that I LONG when the market is dumping and not when market trending up.

If my entry is not accurate, I use DCA to correct my position to get average entry price close to market price and exit once it pull back or reverse.

I believe this way of trading minimize my downside because I will never open LONG at the top.

Of course, it is not perfect and have it’s own risk but there’s no such thing as perfect trading strategy.

Trade LONG only

Throughout the years, I become more risk averse by nature so I focus more on decreasing my risk as much as possible.

By trading LONG only, I cut my risk by more than 50% because SHORT is riskier than LONG for the fact that there’s no limit of how high price can go which mean my risk is unlimited and I don’t like that odd.

Daily % or trade amount is not an important matrix

I ignore things like daily trade amount or % when making my system, I only look at monthly minimum and annual data.

Daily % and trade amount is just the average data from it.

Be Patient

There’s time that my system didn’t give me any trade for days or weeks and I am fine with it, I play the long game and only take trade when the odds is in my favor.

Market is simply not tradable everyday so pursuing trade everyday doesn’t make sense to me.

Trust in your trading strategy

You can only trust your strategy when you understand how it work so it is important to create your own strategy and backtest it properly.

When you have your own strategy, do not get triggered to change your strategy from watching other post their profit while you are not getting any trade.

Let your strategy play out for 3 months, evaluate and improve your own strategy.

Don’t be afraid to make mistake and keep improving

Like I said, there’s no perfect trading strategy meaning there’s always room for improvement.

This is what I usually try to optimized:

DCA setting

Strategy setting

Leverage calculation

Take profit and stop loss

Trading indicator choice

Trading indicator is important variable as it will determine what strategy it will produce.

I personally use Miyagi trading and it is a combination of widely available indicators (VWAP/RSI/MACD to name a few) and made it simple by combining these indicators to work together in one indicator.

Secure Profit

During my last 435% profit, I started that account with $250 and turned it to $1089 in 98 days so I have double my account 2 times.

First step I do when I have 4x my account is to take my risk off the table first and restart from risk free $250.

I will need 12 doubles from $250 to $1 million but I learned my lesson to not let greed get the best of me from taking my profit out.

The market can take it back anytime without warning so the only way to really win and make money from the market is simply to take your profit out when there’s one.

Without making this issue too long, that is some of my current system that I learned through 3 years of pain and I will write more of it in the future newsletter.

Remember that in every field, to be better you have to be willing to take the pain, a lot of it if you really want to get better, that is where the most valuable lessons are and will separate you from others.

Pain in trading term usually mean losing your hard earned money so when you start, keep those pain as minimum as possible by trading with money you can afford to lose until you have dependable strategy.

That’s it for this week.

Thank you for taking the time to read my newsletter.

I’ll see you in the next issue.

Buff.

Reply