- LEVEL UP NEWSLETTER

- Posts

- LUN #005: Miyagi Trading Indicators for Counter Trend Strategy

LUN #005: Miyagi Trading Indicators for Counter Trend Strategy

How to create a simple and effective strategy for counter trading using Miyagi Indicator

GM Traders.

Buff here.

As automation trader, I am in constant search of trading indicator to gain as much edge as possible from the market.

I have watch countless ‘the best indicator/strategy’ video but the same creator also make another ‘best strategy’ video without any live trading result to back it up simply because they don’t really use it.

Indicator that I will write about is the indicator that I have been using for more than a year and I have live result to back it up:

June Update #Binance

Trade 109/105W/4L

WR 96.3%

PnL 107.24%Took out profit on 10th June and reset to initial capital so it’s growing much slower after the spike in profit.

Risk free heading into July.

Let’s go the distance 🏁

— Buff Trade Automation (@LevelupBuff)

11:02 AM • Jul 1, 2023

If you are new to my newsletter and haven’t set up your trading automation, you can set it up in 10 minutes here.

Creating Counter Trend Strategy With Miyagi Indicator

The indicator is called Miyagi, the creator love and inspired by The Karate Kid.

They have 14 days free trial and I can safely say that it won’t be enough to fully know the potential of Miyagi in that short period of time, simply because there’s a lot of combination you can make out of it and each combination need to be backtest first.

That being said, I will try to simplify it to few different possible counter trading strategy for you to start so you can maximized the free trial period.

You can get free trial access from their discord channel, find Todd and ask for free trial access.

Possible Counter Strategy Combination

Note on all strategy:

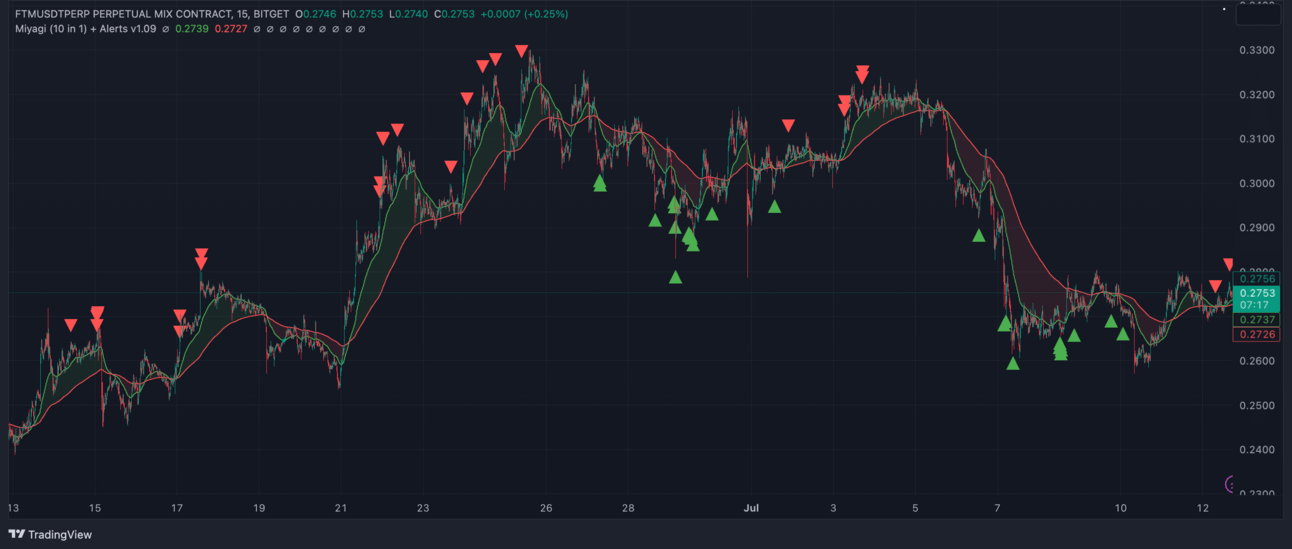

10in1 Miyagi indicator.

FTMUSDT on 15m timeframe.

Using the same DCA strategy mentioned here.

4 months worth of backtest result on each strategy.

All strategy are made close to default setting and DCA strategy is my base setting that I use before I optimize further so this should tell you that this is not a strategy that I recommend to run without further tweaking.

Here we go:

DCA Setting:

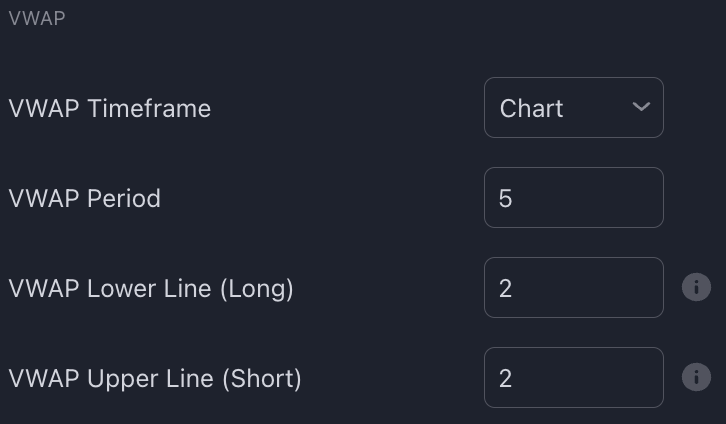

Combo 1: VWAP + RSI

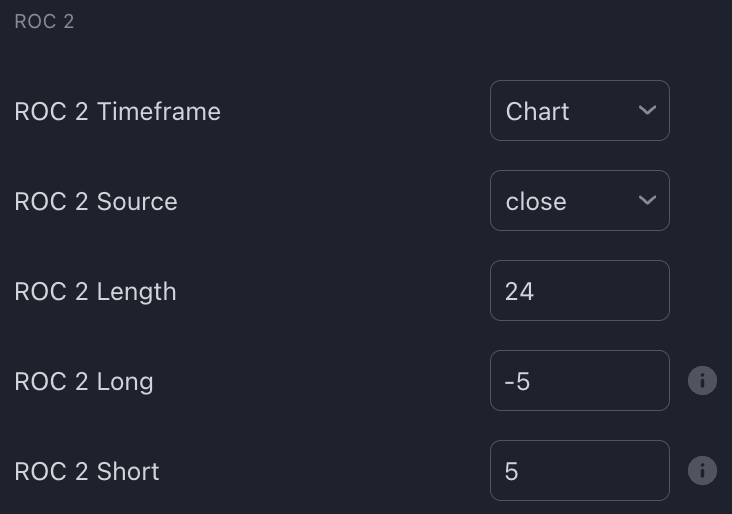

Combo 2: ATR + ROC

Combo 3: EMA + MFI + Stoch RSI

Actionable steps you can take:

Understand how each indicator in Miyagi works in entering a trade. There’s endless resources for this on google and youtube.

Once you understand it, combination will come naturally and you’ll be able to differ which indicator is made for counter, trend or both purposes.

Learn to optimize the accuracy of the entry.

Understand how DCA work in Wickhunter is the next important part of making the strategy. You can use DCA calculator for better visual.

Find the best TP, SL and DCA setting for your strategy using Miyagi backtester.

Key points that I look at on performance summary when starting:

All trades must close and no trades may go for days.

I ignore net profit & avg daily net profit because it can always be optimized through TP, entry size and DCA later. Higher risk = higher profit so when starting, keep the risk to minimum.

What I focus on is always on the quality of signal first, better signal will give me the confidence to bet bigger in that trade.

Max trade time shows the longest trade with this strategy which affect avg trade time. This one really depend on trader’s preference, some trader like me do not like to be in a trade for more than 2 hours so I will try to filter longer trades out.

Max amount bot usage shows the max amount this strategy will use with leverage. On DCA strategy above using $1k as capital and max usage amount of $12k means this strategy need 12-12.5x leverage on 1 pair to run, if you want to use this on 2 pairs, then 24-25x, and so on.

Max spent is how much this strategy actually use.

Total SO deviation shows how wide of % movement you want the DCA to cover. Higher volatility pair usually will need more coverage.

Max SO used is max amount of DCA used out of the 40 that I allow in this example.

In conclusion

Miyagi is a premium indicator and I understand if there’s a hesitation in paying for something without guarantee that you will be able to make your money back, I’ve been there but knowing what I know now, I would have just started right away than messing around with endless free indicator that comes with limitation.

If you are really on a budget, try to start at least with their 6in1 if possible and work your way up from there.

I started trading in hope that it will become my personal printing machine to supplement my full time income and Miyagi is the first indicator that show that it is possible, I started to become consistent and on my way to recover all the losses I made in my early trading years with it.

Nothing worth having will ever comes easy.

Hope this inspire you in leveling up your trading game.

I’ll see you on the next issue.

Thank you for reading,

Buff.

Reply