- LEVEL UP NEWSLETTER

- Posts

- LUN #004: Trading Indicators for Counter Trend Strategy

LUN #004: Trading Indicators for Counter Trend Strategy

How to create a simple and effective strategy for counter trading

GM.

Buff here.

When I started trading counter strategy, trading indicators were not as advanced as today.

Today, free trading indicator on Tradingview is so good that I would have avoided some liquidation in my early trading years.

If you are new to my newsletter and haven’t set up your trading automation, you can set it up in 10 minutes here.

Let’s get to it.

Making Counter Trend Strategy with Tradingview indicator

I recommend to start with these indicators:

First two are free and great option to start, I’ll show you how today.

Miyagi is a premium option which is the one I use and I will cover this separately on the next issue.

Keep in mind that I am giving you guidance on how to create strategy using this indicators, not a live trading strategy.

Wick Connect

Counter strategy is quite simple to make with WC.

Signal frequency ONCE means it will only take 1 trade when condition triggered and no repeat even the condition are still fulfilled.

While signal frequency REPEAT means it will keep taking as long as conditions are fulfilled.

REPEAT will produce more trades but it also means more risk which is not recommended so use ONCE for a starter.

Next, we use RSI 1 and there’s two ways we can go about this:

A. First:

RSI long condition: Crossing up

RSI short condition: Crossing down

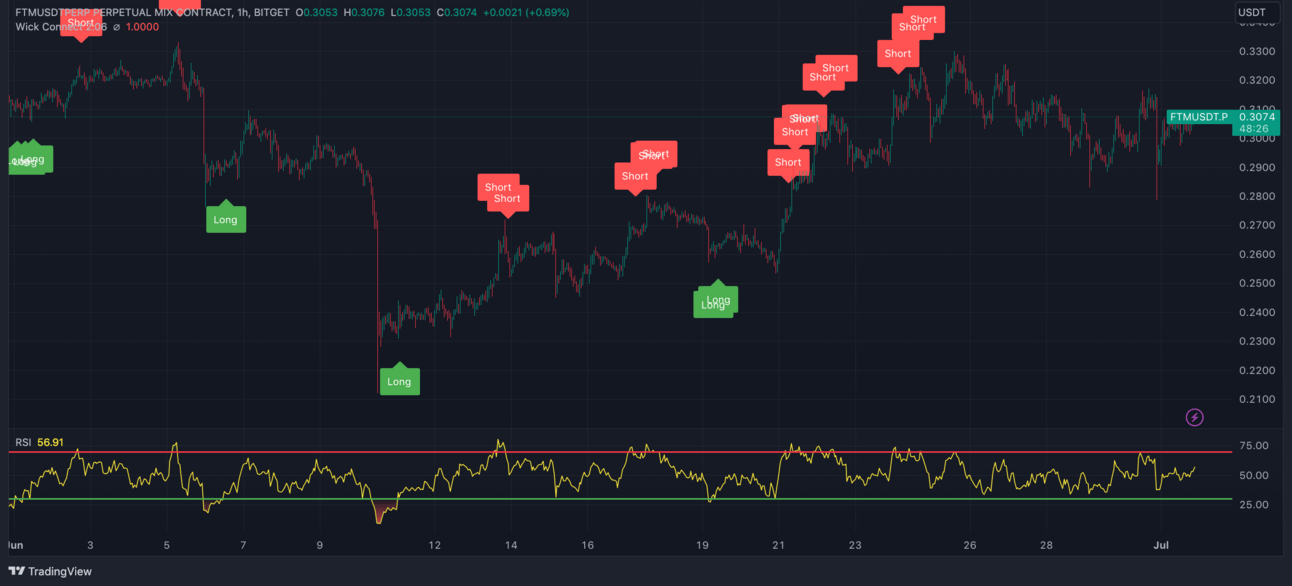

On default 14/30/70 RSI on FTM 1h time frame, it will look like this:

RSI at the bottom for visual purposes

Trigger explanation:

LONG taken only when RSI went below then cross above 30 to trigger.

SHORT taken only when RSI went above then cross below 70 to trigger.

B. Second:

RSI long condition: Less than

RSI short condition: Greater than

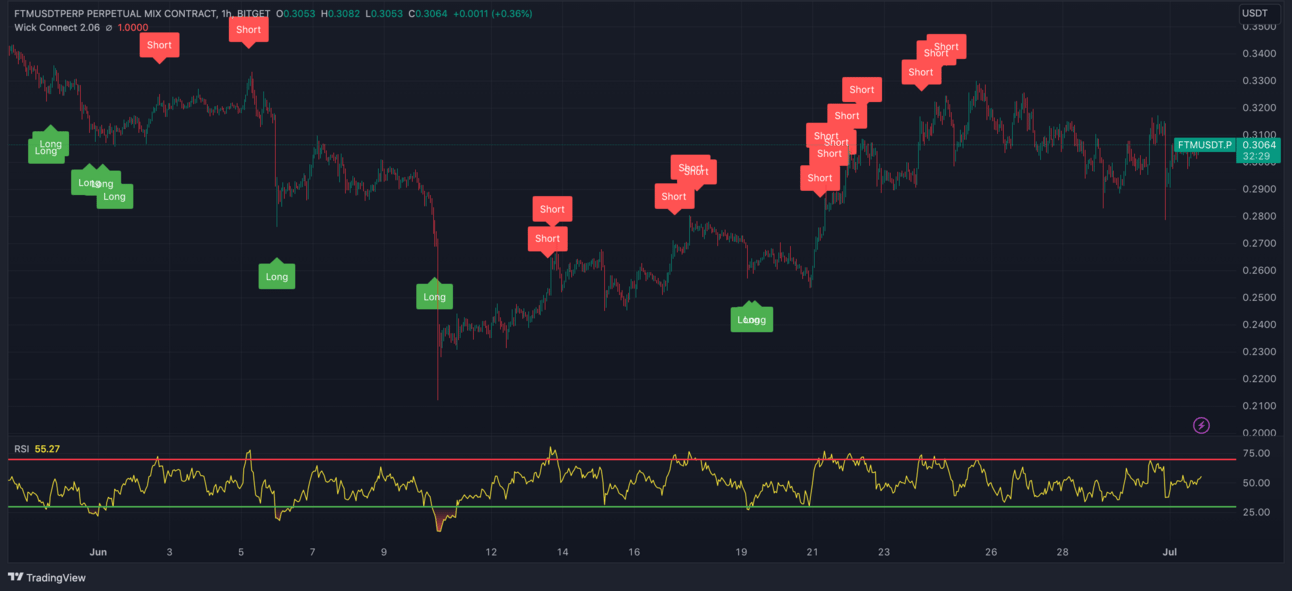

On default 14/30/70 RSI on FTM 1h time frame, it will look like this:

RSI at the bottom for visual purposes

Trigger explanation:

LONG taken only when RSI is lower than 30.

SHORT taken only when RSI is higher than 70.

In this example alone, one LONG was taken too early on the dump with second method and first method allow better entry.

How to improve signal quality for WC:

Increase RSI length in general will slow down the RSI and give better entry.

Go lower for LONG RSI and higher for SHORT RSI

Use higher time frame RSI on RSI 2 and/or 3 using ‘less/greater than’. Higher time frame may enhance signal quality.

Limitation on WC for counter strategy is we can only rely on RSI for signal, even though it produce good quality signal but during highly volatile time, we will need other indicator to filter out unwanted signals.

That brings us to our next indicator.

Wick Hunter MVWAP & RSI

This indicator is using VWAP as trigger which help with nailing local top and bottom entry.

RSI is used as overbought and oversold filter so when both VWAP and RSI condition are fulfilled, it will enter a trade.

Used alone it gives questionable signals but combined, it immediately gives cleaner signals.

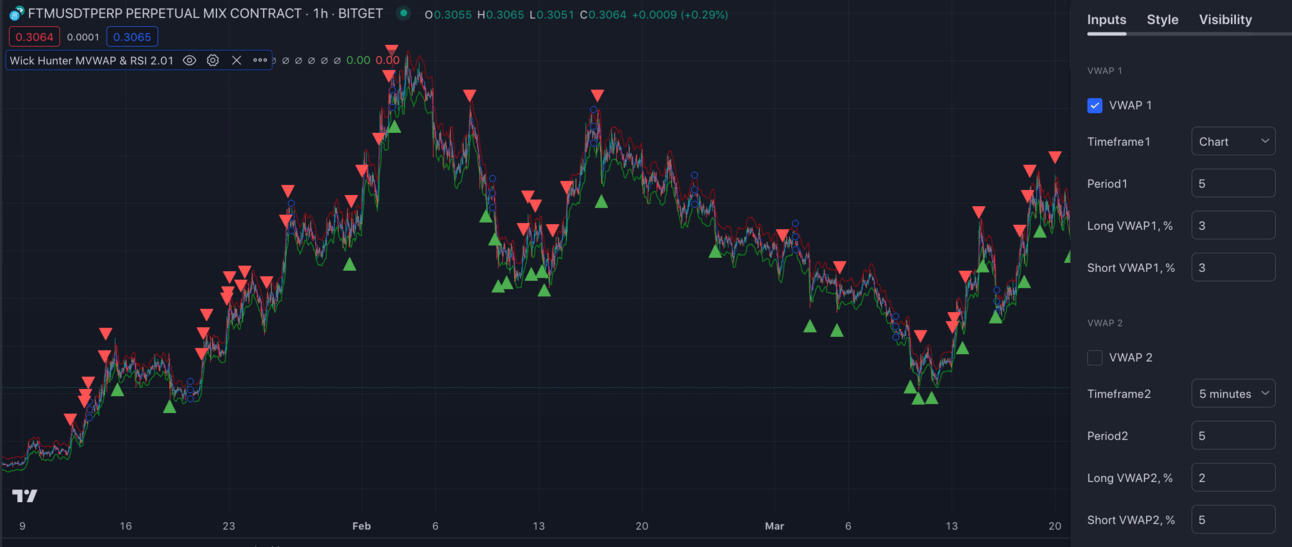

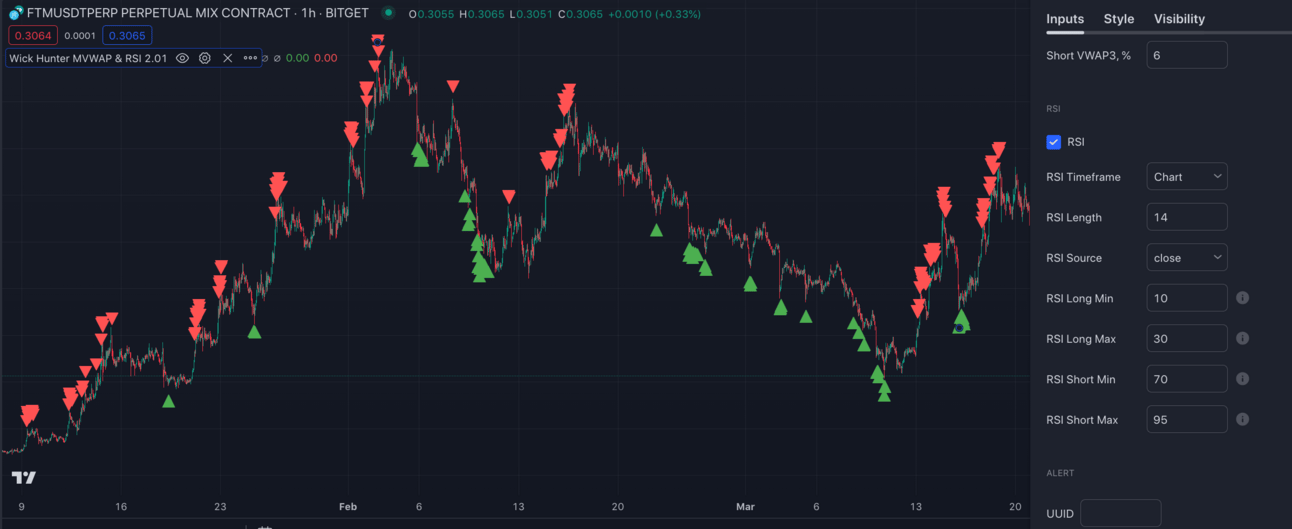

Here’s the difference on FTM 1h time frame:

Using VWAP only with 5/3/3 setting

Using RSI only with Long 10/30 Short 70/95

Using both VWAP and RSI with the same setting

VWAP trigger condition:

LONG taken when price touch green line below candle

SHORT taken when price touch red line above candle

RSI trigger condition:

LONG will be taken when RSI value falls between determined value

SHORT will be taken when RSI value falls between determined value

How to improve signal quality for WH:

Going wider on VWAP LONG/SHORT % will make it ‘safer’ because price will need to be more volatile to trigger.

Going lower with VWAP period also makes it follow price closer so it won’t get caught too early, not always the case on making it safer.

On RSI, going lower on LONG min-max and going higher on SHORT min-max.

Limitation that I found with WH would be that it can be more sustainable if we play it safe because VWAP and RSI combination can only do so much especially when price volatility is high to a point it ignore all indicator and price action.

You can start playing around with these two indicators and see how it can benefit you as a trader.

Test it on different pair, timeframe and market, you’ll see that this simple strategy can be very effective.

Conclusion

It is the season of Formula 1 at the time of this writing and I love to see that same car with different driver can have significant different result. The winner simply know how to extract full potential of the car while the other can’t.

I believe that trading indicator is the car in this analogy and we are the driver so put in the work and find a way to extract the full potential of the car that we have been given.

I’ll see you on the next issue.

Thank you for reading,

Buff.

Reply